Escrow is a key step when buying a home, serving to protect both buyers and sellers.

It ensures that the transaction is secure and goes smoothly up to the closing.

Both parties should engage with their escrow officer and be ready to handle any problems that might come up.

Proper preparation can make the escrow process straightforward and successful.

Here’s what you need to know from beginning to end.

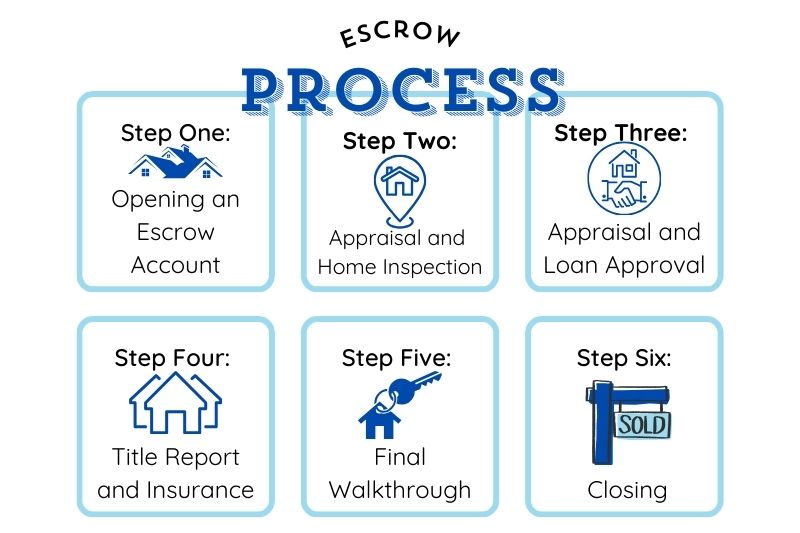

Escrow Process

Step One: Opening an Escrow Account

The escrow process starts with setting up an escrow account. Either the seller or the buyer can initiate this.

To open an account, you need to submit the purchase agreement and any initial deposits to the escrow officer.

The officer will check the contract for accuracy, confirm all necessary signatures are present, and kick off the escrow process.

It’s important for everyone involved to carefully review the purchase agreement terms, as these will guide the entire process.

Step Two: Appraisal and Home Inspection

After opening escross, the buyer enters a crucial phase called the contingency period, which is typically defined in the purchase agreement. This period allows the buyer to conduct thorough inspections and investigations of the property. During this time, the buyer’s mortgage lender will also order an appraisal to assess the value of the home.

Buyers are advised to hire a professional home inspector to examine the property comprehensively. This includes checking the home’s structural integrity, electrical and plumbing systems, heating, and more. This step is vital for buyers to understand the condition of the property they are considering purchasing.

For sellers, this period involves waiting for the buyer to complete their inspections and evaluations. Sellers should be prepared to provide any necessary documents or information to help the buyer’s due diligence process.

Sep Three: Appraisal and Loan Approval

During the closing process, your mortgage provider will arrange for an appraisal. This step is crucial for securing financing, as the appraiser will confirm that the property’s value matches the offered price, protecting the lender in case of foreclosure. If the appraisal is lower than expected, buyers have several options:

- Seek a new lender and request another appraisal.

- Negotiate with the seller to reduce the sale price.

- Withdraw from the deal and look for another property.

- Provide the appraiser with additional information that might increase the property’s appraised value.

Following the appraisal, the next key step is finalizing the loan. Lenders will prepare a loan commitment detailing the mortgage amount, interest rate, term, and closing costs. Buyers should review this information carefully and negotiate the terms with their lender. Once an agreement is reached, the financing contingency can be removed from the purchase agreement, moving the process closer to completion.

Step Four: Title Report and Insurance

Obtaining a title report and title insurance is not only a requirement from lenders, but it’s also a wise protection measure for buyers. The title report checks that the property’s title is clear, meaning there are no existing liens or disputes, and that the seller is the legitimate owner with the full right to sell.

Title insurance provides an additional layer of security for both you and the lender. It protects against potential legal issues that might arise if previously undisclosed complications with the title surface after purchase.

If any problems are discovered with the title, the seller must resolve these issues before the sale can proceed. In some regions, the escrow company and the title company might be the same entity, simplifying this step. If the issues cannot be resolved, buyers typically have the option to terminate the agreement and seek another property.

Step Five: Final Walkthrough

The final walkthrough gives buyers one last opportunity to inspect the property before closing the deal. Although this step isn’t mandatory, it’s strongly recommended. During the walkthrough, check to ensure the property is in the same condition as when you last viewed it and that all terms of the agreement are being met.

Look for any new damage that might have occurred since your previous inspection. If you discover significant issues, you can request the seller to address these before finalizing the sale. Typically, the final walkthrough is scheduled within the 24 hours leading up to the closing. This step is crucial for confirming that everything is as expected before the transaction is completed.

Step Six: Closing

The closing process can vary by state, but generally involves a substantial amount of paperwork. It’s important for both buyers and sellers to carefully review and sign these documents. During this time, make sure to read everything thoroughly and understand what you’re agreeing to.

The seller also has paperwork to complete. Once all documents are signed, the escrow officer will issue a new deed in your name as the new owner and forward it to the county recorder’s office.

To finalize the transaction, you’ll need to provide the remaining down payment, which includes the earnest money already paid, and cover the closing costs. This is typically done through a cashier’s check or a wire transfer. At the same time, your lender will transfer the loan funds to the escrow account. This allows the escrow officer to distribute the funds to the seller and any other parties, such as the seller’s lender if there is an existing mortgage on the property. This marks the official completion of the property transfer and the conclusion of the escrow process.

How Long Does the Escrow Process Take?

The duration of the escrow process can vary widely and isn’t set to a standard timeline.

Several factors influence the length of time needed, including how quickly the buyer obtains mortgage pre-approval and secures financing, and how promptly all involved parties gather and process the necessary documents.

Typically, if everything proceeds smoothly, the escrow process can be completed in as little as 30 days. However, it is more common for it to take around 60 days.

Is Escrow Required?

Whether or not you need an escrow account can depend on the type of loan you choose and its conditions.

For conventional mortgages—those provided by private banks or lenders—an escrow account is usually required if the down payment is less than 20 percent, along with mortgage insurance.

For federally backed loans, the requirements vary: FHA and USDA loans require escrow accounts, whereas VA loans do not.

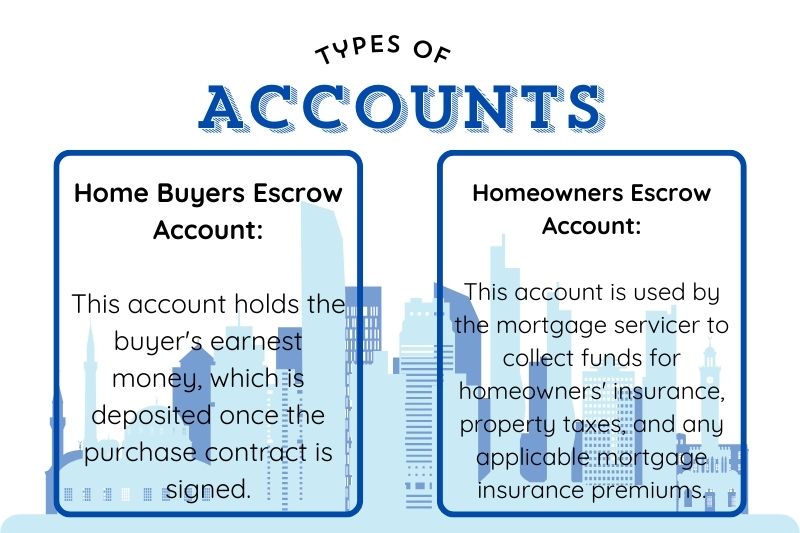

Types of Accounts

There are two main types of escrow accounts used during the home buying process:

- Home Buyers Escrow Account: This account holds the buyer’s earnest money, which is deposited once the purchase contract is signed. The earnest money is typically given to the seller if the buyer cancels the transaction. However, the buyer may receive a refund if specific contingencies are not met, such as issues with the property appraisal, title discrepancies, or if the seller decides to withdraw from the sale.

- Homeowners Escrow Account: Along with the principal and interest payments, this account is used by the mortgage servicer to collect funds for homeowners’ insurance, property taxes, and any applicable mortgage insurance premiums throughout the duration of the loan.

I’m Tanner Murphy, a retired real estate agent from California, now writing for propertyescape.net. I simplify California’s complex real estate laws for readers, making it easier to understand and navigate the market.