In 1978, California passed Proposition 13, a major change to real estate tax law.

It set a cap on property taxes at 1% of a property’s assessed value and limited yearly increases to no more than 2%.

This was done to keep property owners from facing huge tax increases when property values shot up.

Proposition 13 has made a big difference for homeowners, keeping property taxes stable and affecting how affordable homes are for buyers.

In 2024, California’s new initiative to provide homebuyers with $150,000 aims to alleviate some of the affordability challenges posed by Proposition 13’s long-term impact on housing costs.

Proposition 13 has also had a wider impact on California’s housing market.

It has been great for people who have owned their homes for a long time, keeping their taxes from going up too much.

But it has also made it harder for local governments to get the money they need from property taxes.

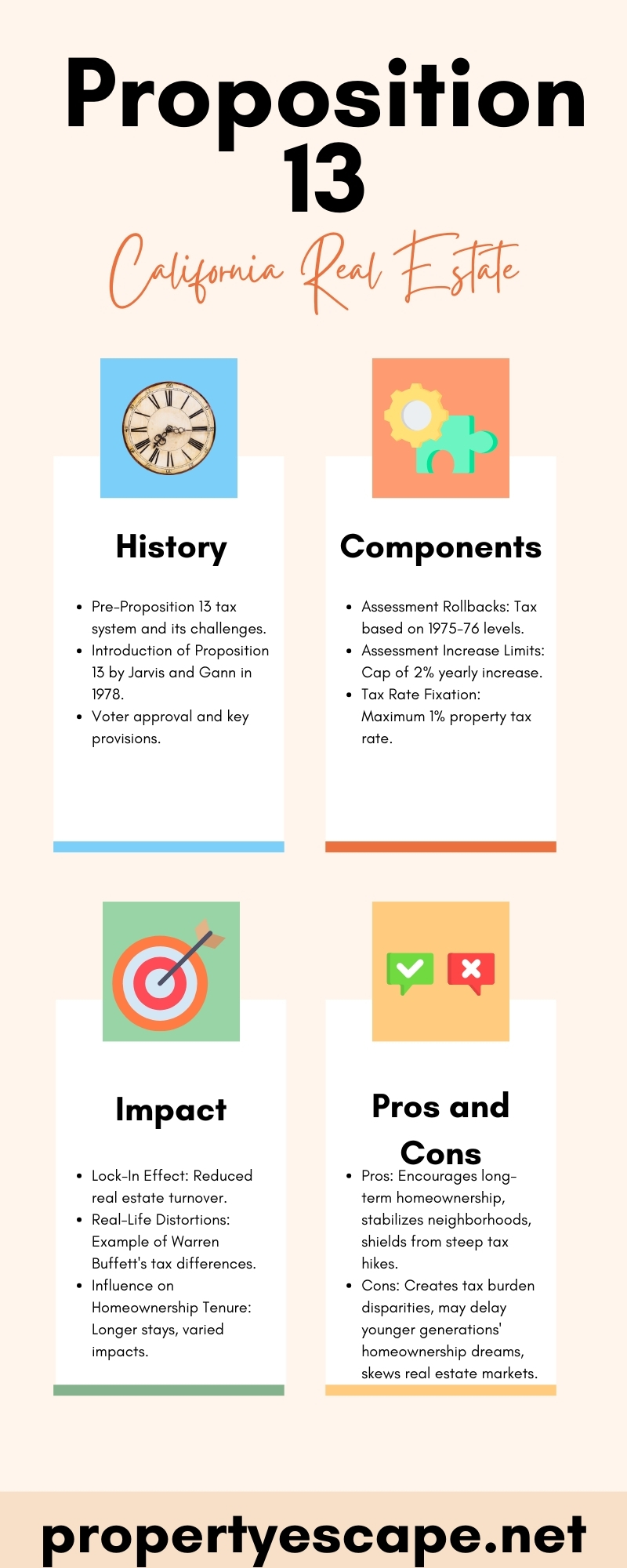

History of This Proposition

Before Proposition 13, California’s property taxes were tied to the ongoing market value of homes, leading to soaring tax bills as property values climbed.

This put a heavy burden on homeowners, particularly those on fixed incomes, who feared losing their homes because of unpredictable tax increases.

In response to growing frustration among taxpayers, Proposition 13 was introduced by Howard Jarvis and Paul Gann. Their goal was to limit property taxes, making them more manageable and predictable for homeowners.

The measure won the approval of California voters in June 1978.

It fixed the property tax rate at 1% of the property’s assessed value at purchase and allowed only a 2% increase per year in that value until the property changed hands

The effect of Proposition 13 on mobility varies widely depending on the size of the subsidy, with the largest effects occurring in coastal California cities where the increase in property values has been greatest.

4 Most Important Components of Proposition 13

1. Assessment Rollbacks

Proposition 13 initiated a rollback of property tax assessments to the 1975-76 levels. This meant that properties were taxed based on their assessed value from that time, regardless of their current market value.

2. Assessment Increase Limits

Under Proposition 13, annual increases in the assessed value of real property were capped at no more than 2% per year, as long as the property was not sold or underwent new construction.

This limit provided predictability in property taxation, shielding owners from significant tax hikes.

3. Reassessment Conditions

Reassessments could trigger a reset to current market value, but only under two conditions: a change in ownership or completion of new construction.

The impact of such reassessment had a stabilizing effect on the financial aspect of homeownership in California.

4. Tax Rate Fixation

Proposition 13 set a maximum property tax rate at 1% of the assessed value, with the possibility of added fees for voter-approved local indebtedness.

This tax rate cap brought uniformity and predictability to the property tax system in California.

The Lock-In Effect

This phenomenon doesn’t just influence homeowners; it ripples through the rental market too.

Landlords directly feel the impact since Proposition 13 applies to them as well.

Indirectly, it leads to fewer owner-occupied homes hitting the market, affecting overall real estate turnover.

Real-Life Distortions: A Warren Buffett Snapshot

In 2003, Warren Buffett, a titan in the investment world, highlighted the stark contrast Proposition 13 brought into his life.

Despite his Nebraska home’s modest $500,000 tag fetching a $14,410 property tax bill (2.9 percent), his $4 million California abode cost him a mere $2,264 in taxes (0.056 percent).

It’s a vivid illustration of Proposition 13’s impact, underscoring that it’s not just about savvy investment moves but also about the legislative landscape.

Proposition 13 and Its Influence on Homeownership Tenure

Research shines a light on how Proposition 13 has cemented the average stay of California residents in their homes.

Between 1970 and 2000, homeowners and renters in California found themselves settling in for longer periods compared to folks in other states—homeowners by an additional 1.04 years and renters by .79 years.

This trend underscores a significant boost in stability and continuity within communities.

Racial and Migrant Impact

The effects of Proposition 13 aren’t distributed evenly across the board.

African-American households, for instance, have seen a more pronounced increase in tenure length than their white counterparts.

Similarly, migrants to California have tended to stay in their homes longer than those born within the state, highlighting the policy’s varied impact on different demographics.

Geographical Nuances: Coastal vs. Inland

The proposition’s influence isn’t uniform across California either.

Coastal cities, where property values have skyrocketed, witness more pronounced tenure extensions than their inland counterparts.

The disparities raise questions about the balance between community stability and the economic trade-offs of reduced tax revenues and regional resource redistribution.

Pros and Cons

As we’ve seen, Proposition 13 has been a double-edged sword.

On one hand, it’s promoted neighborhood continuity and stability, helping residents plant deeper roots in their communities.

On the other, it introduced market distortions and widened the gap between coastal and inland areas.

Pros

- Encourages long-term homeownership

- Stabilizes neighborhoods

- Shields homeowners from steep tax hikes

Cons

- Creates disparities in tax burdens

- May delay younger generations’ homeownership dreams

- Potentially skews the real estate market, especially in high-value areas

The Bottom Line

Is Proposition 13 a boon or a bane for California’s real estate landscape?

It’s a complex question, one that invites further scrutiny and discussion.

While it’s clear that the policy has helped foster stability and continuity in many communities, it also poses challenges in terms of equity and economic efficiency.

Amidst these considerations, Californians must also remain vigilant against potential real estate scams, safeguarding their investments and ensuring the integrity of the market.

I’m Tanner Murphy, a retired real estate agent from California, now writing for propertyescape.net. I simplify California’s complex real estate laws for readers, making it easier to understand and navigate the market.

Related Posts:

- The Impact of California Wildfires on Real Estate Markets

- How to Avoid Real Estate Scams in California: 6 Tips…

- What is Steering in Real Estate? How to Avoid It?

- The Pros and Cons of Investing in Real Estate Crowdfunding

- The Process of Foreclosure in California: Bill of Rights

- My Guide to Investing in Vacation Properties in…