I apologize if my previous attempt didn’t meet your expectations. Let’s try a different approach:

When you inherit a house, it’s not just about getting a new home. You’re also taking on the taxes and debts that come with it. This includes estate and capital gains taxes and any remaining mortgage.

The house also demands decisions. Will you sell it, move in, or rent it out? Renting might help with costs and could bring in extra income.

A second property can boost your wealth. But, dealing with taxes and upkeep can be overwhelming. If that’s too much, selling might be the best move.

In California, inheriting a house means dealing with estate taxes. Planning can help you avoid a big tax bill.

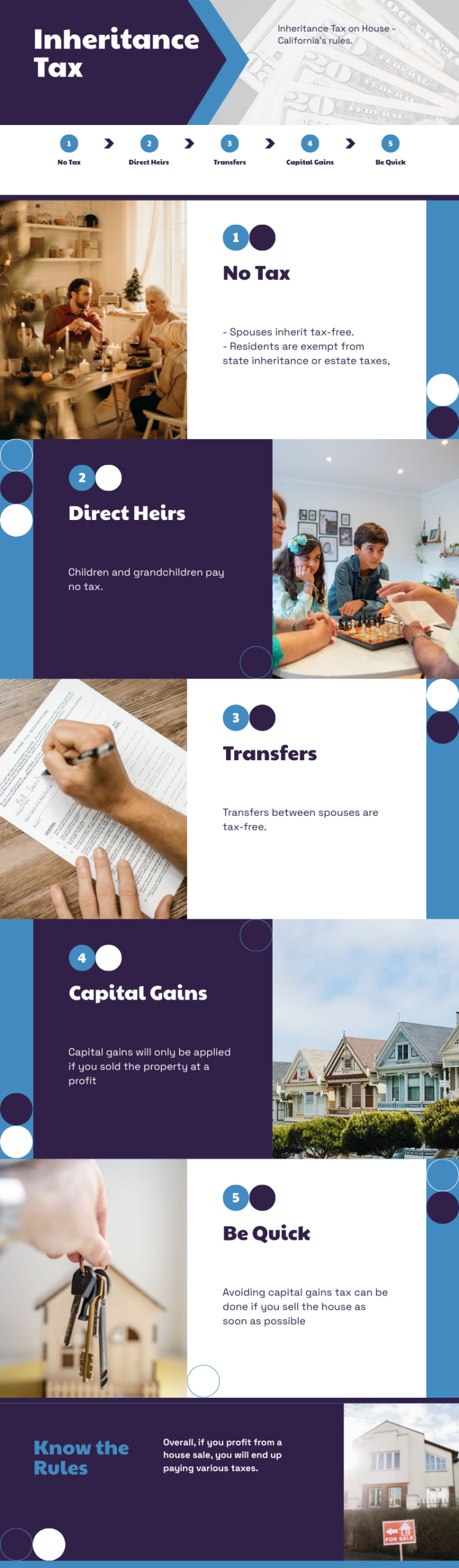

Federal, State, and Inheritance Tax on House Rules Explained

When it comes to estate taxes, the rules can vary significantly from one jurisdiction to another. In California, for instance, residents are exempt from state inheritance or estate taxes, as the rate is 0%. However, they must adhere to federal estate tax regulations, which apply to certain large estates.

- Inheritance Tax: This is a state tax levied on money or property received from a deceased person. As of 2022, only six states in the U.S. impose an inheritance tax. It’s important to note that inheritance tax is distinct from estate tax, which is more widespread. The estate tax, sometimes referred to as a “death tax,” is levied on the total value of a deceased person’s estate before distribution to any heirs.

Lana Dolyna, Senior Tax Advisor from Roseville, explains in her article on Tax Shark that California does not impose an inheritance tax, estate tax, or gift tax. Nonetheless, Californians are subject to federal regulations concerning gifts made during one’s lifetime and the estates of deceased residents. For example, in 2021, individuals could gift up to $15,000 tax-free within a tax year, a figure that rose to $16,000 in 2022. Estates valued below $12.06 million for single individuals in 2022 are exempt from federal estate tax.

Inheritance Tax vs Estate Tax

Estate taxes are levied by the federal government (and potentially by some states) on the assets of the deceased before they are passed on to the beneficiaries. These assets can include real estate, cash, stocks, and other possessions, as explained by Ashley Kilroy in her article on SmartAsset.

Ashley further explains that the estate tax is only applicable if the total value of the estate exceeds a certain threshold, which was $11.7 million for individuals and $23.4 million for married couples in 2021. The tax rate varies between 18% and 40% depending on the amount by which the estate exceeds this threshold.

What About Capital Gains Tax?

While properties in California are not subjected to either state or estate tax, the last common addition to your tax bill, capital gains tax, remains the biggest tax expense facing beneficiaries in California.

Capital gains are a special type of tax that relates to the profit an asset like real estate generates once it’s sold, and if you decide to sell the house down the line, you will be subjected to it in the state of California.

Mary Randolph gave a simple example in her article on AllLaw:

How to Avoid Inheritance Tax and Capital Gains Tax in California

So, the good news is that if your inherited property is in California, you won’t have to pay any state tax on the house at all, and on top of that, the few states that apply tax for asset recipients are already dwindling down due to its increasing unpopularity.

Some people go as far as calling it a “death tax”, so it’s not surprising that even the few states that still apply it are considering scrapping it all together!

Avoiding capital gains tax, however, is a whole different challenge: In most cases, your capital gains liability will kick in as soon as you sell the property, and it can be quite hard to assess how much you’re going to pay in advance as the IRS taxes capital gains differently than other inheritance taxes.

In fact, how much you’re going to pay will largely depend on how long you hold the asset.

You might be charged a short-term capital gains tax rate if you have held the asset for less than one year, while you’ll be taxed according to the long-term capital gains tax rate if you have held it for longer than one year.

As of 2021, the maximum you could pay for short-term capital gains is 37%, while in the case of long-term capital gains, you can expect to be taxed either 0%, 15%, or 20% depending on your income and marital status.

But as a general rule of thumb, capital gains will end up on your tax bill and potentially eat into your taxable income, so if you find yourself owning a property through inheritance, you’ll have to be prepared to deal with hefty taxation.

Now, what can you do if you want to sell your inherited home and make a profit while avoiding paying hefty capital gains taxes? Here are four ways you can avoid capital gains tax when you sell your property:

Sell the Property as Fast as You Can

The easiest way to avoid property headaches and capital gains tax is to sell the home as fast as possible, so the sale will be classed as a short-term capital gain and be taxed at a much lower rate.

This means that if you don’t let the property appreciate over time and sell at the same price it was worth according to the step-up basis (the value at the time of the inheritance), you’ll be able to avoid paying capital gains altogether!

Of course, selling a home that fast is no easy feat, and you’ll have to factor in the expenses of hiring a realtor to list it on top of appraisals, upgrades, and any other property expenses you’ll need to shoulder to sell quickly.

Make the Property Your Primary Residence

Another effective yet more complex way to avoid capital gains tax is to convert the inherited property into your primary residence and occupy it for at least two years, so you can take advantage of the lenient IRS capital gains tax rules for a primary residence.

If you are single, you will already be allowed a $250,000 tax write-off for the sale, while if you are married and filing jointly you’ll be able to shave off as much as $500,000 off your tax bill, which might come up as the entire amount of the sale.

You can only qualify for these exemptions if you’re applying for your primary residence, so if you are open to relocating and living in the inherited property for at least two years, you’ll be able to avoid paying capital gains altogether!

Defer Your Taxes as An Investment Property

Another more complex way of avoiding taxes on inherited property is to turn the inherited asset into an investment property, renting it out to tenants for a sizable period before selling it and filing a 1031 exchange to purchase another investment property.

When you invest in another investment property to replace the inherited home under the 1031 exchange, you’ll be able to defer capital gains taxes, which you can continue doing with multiple properties almost infinitely, growing your portfolio, equity, and profit at the same time.

Of course, this course of action is best suited for those who want to enter the real estate investing world and become real estate professionals, so if you’re not prepared to deal with such a complex journey, you’ll be better off selling as fast as you can, keeping the house as a second home, or simply refusing the inheritance in the first place.

And on that note…

Disclaim the Inheritance Altogether

The fastest and perhaps most convenient way to avoid paying any tax on your inherited asset is to simply disclaim the inheritance altogether.

This means that you can choose to refuse to inherit once you are informed of your loved one’s will, saving you from all the tax hassles and responsibilities that come with the asset.

Keep in mind that you won’t be able to change your mind once you disclaim the inheritance, and depending on your situation, refusing your loved one’s will might be a lot harder than just keeping or selling the home.

Conclusion

In California, inheriting a house means no state taxes, but federal estate and capital gains taxes still apply. Consider your options: sell fast, make it your home, rent it out, or decline the inheritance. Each has tax implications, so understanding and planning are key to making the most of your inheritance.

I’m Tanner Murphy, a retired real estate agent from California, now writing for propertyescape.net. I simplify California’s complex real estate laws for readers, making it easier to understand and navigate the market.

Related Posts:

- How Much Tax Do You Pay When You Sell Your House in…

- How to Buy a House in California: All You Should Know

- House Under Contract vs Pending: What’s the Difference?

- The Process of Foreclosure in California: Bill of Rights

- My Guide to Investing in Vacation Properties in…

- California Will Give Homebuyers $150,000 to Buy Houses