Ah, California! Land of sunshine, stunning coastlines, and dreams. But when it comes to buying a house here, things can get pretty real, pretty fast. This is one of the most significant investment decisions you’re likely going to make during your lifetime, so you need to prepare well.

If you don’t do due diligence, you may end up making a terrible decision and buying the wrong home. In this article, we’ll guide you through the entire process of acquiring your property in California if you are financially ready for it.

Things to Consider Before Buying a Home in California

1. Mortgage

Average mortgage rates in California could vary significantly depending on the economic climate, Federal Reserve policies, and individual lender rates.

But, for a 30-year fixed mortgage, rates have been observed to fluctuate between the low 3% to over 5% in recent years. These rates are also influenced by your:

- credit score

- down payment size

- loan amount

- the type of loan you’re applying for

How to Calculate Your Mortgage?

You’ll need the principal amount (home price minus your down payment), the interest rate, and the term of your loan. Mortgage calculators available online can simplify this process, but here’s the basic formula for monthly mortgage payments (principal and interest):

M=P(1+r)n−1r(1+r)n

Where:

- M is your monthly payment.

- P is the principal loan amount.

- r is your monthly interest rate (annual rate divided by 12 months).

- n is your number of payments (loan term in years multiplied by 12).

Example: For a $500,000 home with a $100,000 down payment (so, a $400,000 loan) at a 4% interest rate on a 30-year fixed mortgage:

- Principal (P) = $400,000

- Annual interest rate = 4% (or 0.04 annually, 0.0033 monthly)

- Loan term = 30 years (or 360 months)

Using the formula, the monthly payment (principal and interest) would be approximately $1,910. This doesn’t include property taxes, homeowners insurance, or PMI if your down payment is less than 20%.

2. Location

When choosing a location, consider:

| Factor | Description |

|---|---|

| Proximity to employment | High-paying jobs in tech, entertainment, and finance are concentrated in the Bay Area, Los Angeles, and San Diego. |

| Lifestyle preferences | Coastal areas offer beach lifestyles but come with higher price tags. Inland areas like the Sierra foothills provide more space and natural beauty at a lower cost. |

| Climate | Northern California offers cooler weather and four seasons in some areas, while Southern California is known for its year-round mild to warm climate. |

How to Choose a Proper Location?

- Research extensively: Use online tools to research median home prices, property taxes, and cost of living in different California regions.

- Visit potential areas: Spend time in areas you’re considering to get a feel for the community, commute times, and local amenities.

- Consider future growth: Look into the area’s future development plans, as this can affect home values and quality of life (e.g., new schools, transportation projects).

3. Budget

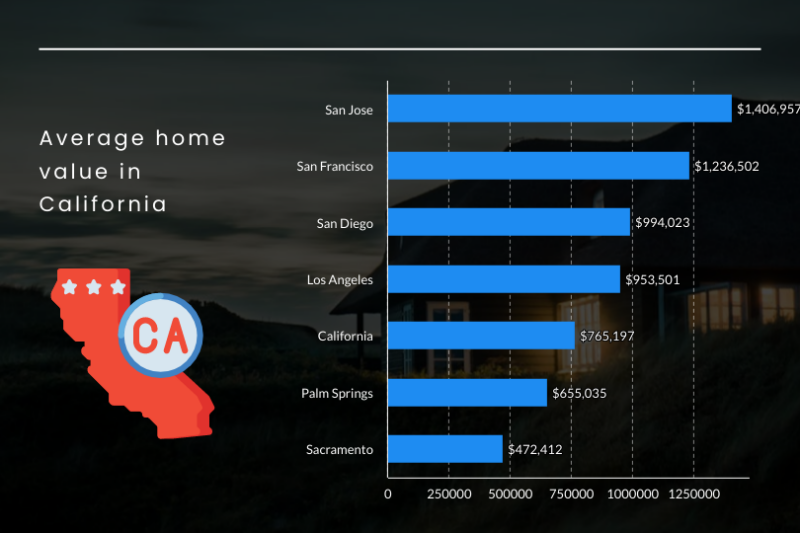

California’s high cost of living is no secret. The state has some of the highest property prices in the country, with significant variances between regions:

Additional Factors Influencing Budget

- Property Taxes: California’s average property tax rate is around 0.73-1%, but this can vary by county. For a home priced at the state median value, this translates to an annual tax bill in the thousands, an important factor to consider in your budget.

- Insurance Costs: Homeowner’s insurance rates in California can also vary significantly depending on the location’s risk of natural disasters such as wildfires, earthquakes, and floods.

- HOA Fees: If you’re buying in a planned community or condo, you may also need to budget for Homeowners Association (HOA) fees, which can range widely but significantly impact your monthly housing costs.

Availability of Houses for Sale in California

Buyer demand is at an all-time high in places like San Diego and Los Angeles. For example, in Los Angeles, the average price of a condo is $550,000, while a single-family home commands an average of $860,000.

Did you know? In 2023, California experienced a notable decline in home sales, with a total of 257,630 homes sold throughout the state.

These prices are not likely to go down anytime soon. The California Association of Realtors has predicted that the median price of homes in the state will go up by 6.2% in 2024.

You should also remember that sellers will always prefer a cash offer over one that requires a loan payment. So if you’re up against a buyer that is offering all cash for the property you wish to buy, it’ll be difficult for the homeowner to accept your offer.

Do I Need to Hire an Attorney?

California laws do not require buyers in a real estate transaction to hire a lawyer to represent them at the closing. The Residential Purchase Agreement and Joint Escrow Instructions form are usually the only requirements to make an offer.

If the seller accepts your offer, he signs the forms, which eventually serve as the final contract.

What Are Unique Laws Applicable Only in California?

- Agents from the same agency: You should know that a single agent or two agents from the same agency can represent both the buyer and the seller. This practice isn’t widely accepted, but California laws permit it.

- The Disclosure: Signing the Disclosure Regarding Real Estate Agency Relationships form, a written consent, you can carry on with your transaction. The purpose of the document is to identify the agents and brokers representing both parties in the transaction.

- Report: In California, it’s also mandatory that the home seller gives the prospective buyer an in-depth report on the architectural conditions of the property. This information is usually in a written disclosure form from the landlord.

Step-by-Step Guide on Buying a House in California

Let’s talk about how to buy a house in California:

1. Get Preapproved

A preapproval letter is a document issued by a lender that indicates you qualify for a loan up to a certain amount, based on an initial review of your creditworthiness. This letter typically includes:

- the amount you are preapproved for

- the loan type

- an estimated interest rate.

The letter serves as proof to sellers that you are a serious and financially capable buyer, which is particularly important in competitive housing markets like many found in California.

The process of obtaining a preapproval letter involves filling out a loan application with a lender. You’ll need to provide detailed financial information, including proof of income (such as W-2 forms or tax returns), bank statements, assets, and liabilities, as well as consenting to a credit check. The lender will use this information to assess your financial health and determine how much money they’re willing to lend you and under what terms.

The preapproval letter is typically filled out and signed by the lender, stating their commitment to lend you the funds. But, it’s important to note that this commitment is usually conditional upon further verification of your financial status and the appraisal of the property you decide to buy. Most preapproval letters are valid for 60 to 90 days, after which you may need to renew the application process if you haven’t made a purchase.

2. Find a Real-Estate Agent

Here is how to find an ideal real-estate agent:

- Check credentials: Ensure the agent is licensed in California and has no disciplinary actions. This information is available on the California Department of Real Estate website.

- Experience matters: Look for an agent with specific experience in the type of property you’re interested in and the neighborhoods you’re targeting. An agent with a strong track record in your area of interest can provide critical insights and advice.

- Communication is key: Choose an agent who communicates in a way that suits you, whether that’s text, email, phone, or in-person meetings. Your agent should be responsive and able to explain complex real estate terms in understandable language.

- Compatibility: Since you’ll be working closely with your agent, ensure there’s a good personality fit. You want someone who listens, understands your needs, and whom you trust to advocate on your behalf.

- Try it out: Go to a showing or two with the real estate agents you’re considering working with before signing the agency’s buyer agreement. It’s a test drive of sorts, and you’ll confirm beforehand that you can work with the agent before you commit.

3. Find Your Dream Home

House hunting in California is an exciting phase of the home-buying process, where you get to explore potential homes that could become your new residence. Start by defining your criteria for the ideal home, including location, size, type (single-family, condo, townhome), and specific features (number of bedrooms, bathrooms, yard space, etc.)

Use online real estate listings platforms like Zillow, Realtor.com, and Redfin, which offer databases of available properties across California. These platforms allow you to filter searches according to your preferences, view detailed property information, photos, and sometimes even virtual tours. Also, set up alerts to be notified immediately when new properties that match your criteria hit the market, ensuring you don’t miss out on potential homes.

Your real estate agent will also play a crucial role in this phase. They can provide access to listings that may not be publicly available and arrange private showings. Given their familiarity with the local market, agents can offer invaluable insights into neighborhoods, schools, and other community aspects that might influence your decision.

Pro tips:

- Visit Open Houses: Attending open houses gives you a firsthand look at various properties and helps you refine your preferences by comparing different homes in person.

- Explore Neighborhoods: Spend time in the neighborhoods you’re considering at different times of the day and week to get a feel for the local atmosphere, traffic patterns, and amenities.

4. House Inspection and Appraisal

A house inspection is a detailed examination of the physical structure and systems of a home, from the roof to the foundation.

Hiring a qualified home inspector is essential. Look for someone certified by reputable organizations such as the American Society of Home Inspectors (ASHI) or the International Association of Certified Home Inspectors (InterNACHI). The inspector will check for any signs of structural damage or items that may need repair, including the electrical system, plumbing, heating and cooling systems, insulation, walls, ceilings, and floors.

Because houses stay on the market for an average of 40 days in California, the asking price may be high. The seller will also probably be receiving multiple offers, so you’ve got to move fast once you’ve decided on a house.

Pro tips:

- Attend the inspection: Being present allows you to ask questions and receive firsthand explanations of the inspector’s findings.

- Review the report carefully: Inspectors provide a detailed report highlighting any issues. Use this to negotiate repairs or credits with the seller.

- Budget for repairs: Even in well-maintained homes, inspections can reveal issues. Set aside a budget for potential repairs.

5. Make an Offer

Since you’re competing against other home buyers, be intentional about getting your offer accepted. Working with real estate professionals is a real plus at this point. An agent will ensure you get the best deal.

While negotiating with the seller, the property’s price isn’t the only topic to discuss. Remember you’re paying most of the closing costs from your pocket; as such, you can ask for a seller concession where the closing cost is paid by the seller and put on your mortgage.

Most sellers want to know that their house is in good hands, and your personal letter should convince them as such.

6. Closing the Deal

Before closing the deal, make sure you do a final walk-through of the house. This move enables you to make a final confirmation that the house is in prime condition. It’s good practice not to start buying things that you reckon you’ll be needing to live comfortably in the new home until you have conclusively closed the deal.

Understandably, there’s an excitement to move in, and rightly so; however, several things can go wrong at the last minute.

The landlord may refuse to close escrow, or you may disagree with them concerning the repairs to perform in the house. The landlord may even get a better offer at the final minute and decide not to sell to you anymore. Therefore, ensure you’ve signed all paperwork before you make any big buys.

How Much Do I Have to Make in Down Payments?

Traditionally, a 20% down payment is ideal as it avoids the need for PMI, which lenders require to protect themselves if you default on the loan. PMI can add 0.3% to 1.5% of the entire loan amount on an annual basis to your mortgage payments.

But, in California’s expensive market, saving for a 20% down payment can be daunting. For example, with median home prices in some areas exceeding $1 million, a 20% down payment would be $200,000 or more.

Lower Down Payment Options

Fortunately, there are options for those who can’t afford a 20% down payment:

- FHA Loans: Backed by the Federal Housing Administration, these loans allow down payments as low as 3.5% for those with credit scores of 580 or higher. For a $500,000 home, this means a down payment of $17,500.

- VA Loans: For veterans, active military members, and some surviving spouses, VA loans offer the possibility of 0% down.

- Conventional 97 Loans: Certain lenders offer conventional mortgage options with as little as 3% down for first-time homebuyers or those who haven’t owned a home in the last three years.

FAQs

Conclusion

Whether you’re a first-time or a returning buyer, owning a house in California is a wise financial decision. As a first-time homebuyer, you have complete assurance that your monthly costs will reduce considerably since you don’t have to pay rent.

And although the process is long and often complex, it can be a lot easier with correct information and help from professional agents. Now that you know how to buy a house in California how about getting to work immediately?

Buyers are snatching up homes in California quickly at the moment, and there isn’t a better time to buy a house in CA than now. Low availability of places also means that if you decide to sell your house, you can rest assured that it will be off the market in as little as 50 days.

I’m Tanner Murphy, a retired real estate agent from California, now writing for propertyescape.net. I simplify California’s complex real estate laws for readers, making it easier to understand and navigate the market.

Related Posts:

- How Much Tax Do You Pay When You Sell Your House in…

- California Will Give Homebuyers $150,000 to Buy Houses

- Where And How To Find Abandoned Property For Sale?…

- Single-Family Home Vs. Townhouse - Which Is Right for You?

- Inheritance Tax on House - How Much Will I Pay in…

- House Under Contract vs Pending: What’s the Difference?