Choosing between a single-family home and a townhouse is a significant decision for any Californian.

If you can’t decide on which house to choose, We’ll give you the key differences between these two types, their benefits, and drawbacks, to help you make an informed decision that fits your lifestyle, budget, and preferences.

What Should You Know About Single-Family Homes?

A single-family home is exactly what it sounds like – a standalone house meant for one family. It comes with its land, offering you privacy and space.

Fun fact: Single-family homes have evolved over the years, with various styles emerging from Postmedieval English abodes in the 17th century to Tudors in the 19th century and modern “McMansions” in the 1990s. The size of single-family homes has significantly increased over time, reflecting changing lifestyles, wealth, and design preferences

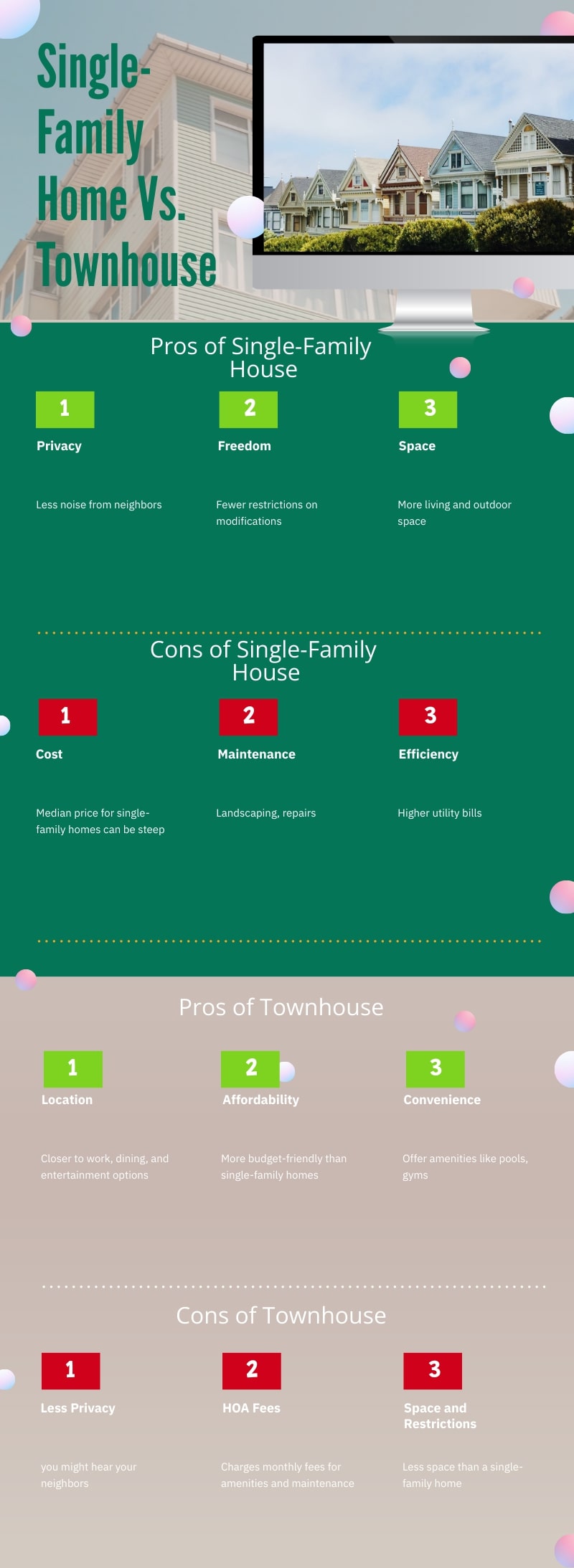

Here are the pros and cons of single-family homes in California:

Pros

- Privacy: Your own space means less noise from neighbors and more room for personal activities.

- Freedom: Want to paint your house neon green? Go for it. Single-family homes often come with fewer restrictions on modifications.

- Space: Generally, you’ll find more living and outdoor space compared to townhouses.

Cons

- Cost: In California, the median price for single-family homes can be steep, especially in hot markets like San Francisco or Los Angeles.

- Maintenance: All that space is great until you have to maintain it. Landscaping, repairs, you name it – it’s all on you.

- Efficiency: Larger spaces can mean higher utility bills and more effort to clean.

What Should You Know About Townhouses?

Townhouses share one or two walls with adjacent properties and often come in rows. They offer a middle ground between single-family homes and condos. In California, townhouses can be a way to get closer to the action of city centers without the price tag of a single-family home in the same area.

Here are the pros and cons of townhouses in California:

Pros

- Affordability: Townhouses are often more budget-friendly than single-family homes, making them a great entry point into homeownership.

- Convenience: Many townhouse communities offer amenities like pools, gyms, and maintenance, taking some chores off your hands.

- Location: They’re often located near urban centers, putting you closer to work, dining, and entertainment options.

Cons

- Less Privacy: Sharing walls means you might hear your neighbors. And sometimes, they might hear you.

- HOA Fees: Most townhouses come with a homeowners association (HOA) that charges monthly fees for amenities and maintenance.

- Space and Restrictions: You’ll likely have less space than a single-family home. Plus, HOAs can limit what you can do with your property.

How to Make a Decision?

When buying a house, choosing between a single-family home and a townhouse involves considering various factors, such as:

1. Assess Your Lifestyle Preferences

- Privacy vs. Community: Do you value having your own space with no shared walls, or do you prefer being part of a community with close neighbors and shared amenities?

- Maintenance: Consider how much time and money you’re willing to spend on maintenance. Single-family homes require more effort and expense to maintain, while townhouses often have HOAs that handle exterior maintenance.

- Space Needs: Evaluate your space requirements, including outdoor space. Single-family homes typically offer more space inside and out, while townhouses might have limited outdoor areas.

2. Financial Considerations

Single-family homes are generally more expensive than townhouses in both purchase price and ongoing maintenance costs. The average price for a single-family home in California in is around $860,300. This price aligns with a projected 6.2% increase in California’s median home price compared to the previous year. On the other hand, townhouses in California can range from around $489,000 to over $1,099,000, depending on the area.

Ensure you understand all costs involved, including HOA fees for townhouses, which can significantly impact your monthly budget. In California, the average HOA fee was approximately $300 per month, but it’s common to pay between $600 to $700 in HOA fees.

Think about the potential resale value and investment aspects of the property. Single-family homes often offer better appreciation potential, but townhouses can be a good investment in high-demand urban areas.

Also, homeowners’ insurance and property taxes can differ significantly between single-family homes and townhouses, affecting your overall costs.

3. Think About the Future

Consider your long-term life plans, including family size, career goals, and lifestyle changes. What works for you now may not suit your needs in 5-10 years.

Single-family homes usually offer more flexibility for expansions or significant remodeling, which could be important if your family grows or your needs change.

4. Location and Community Amenities

Your preferred location might dictate your choice. Single-family homes are more common in suburban areas, while townhouses might be more available in urban settings.

Also, if access to amenities like a pool, gym, or community center is important to you, a townhouse in a planned community might be more appealing.

5. Evaluate the Homeowners’ Association (HOA)

HOA fees in California typically cover a range of services and expenses, such as:

| HOA Fee Allocation | Description |

|---|---|

| Maintenance | Covers maintenance and repair of common areas such as landscaping, roads, sidewalks, and community facilities like pools, gyms, and parks. |

| Insurance | Contributes to building insurance for shared structures and liability insurance for the association. |

| Management Costs | Helps cover administrative costs, including hiring property managers, accountants, and legal services to oversee the association’s operations. |

| Utilities | Some HOAs include utilities like water, sewer, and garbage collection in their fees. |

| Reserve Fund | Allocates a portion of the fees to a reserve fund for larger-scale projects, emergency repairs, or unexpected expenses. |

| Community Services | Goes towards amenities and services like security services, landscaping enhancements, community events, and other benefits for residents. |

FAQs

Conclusion

Choosing between a single-family home and a townhouse depends on your budget, lifestyle, and priorities. Single-family homes offer privacy and freedom at a higher cost, while townhouses provide convenience and amenities with less privacy.

Consider all factors carefully to make a choice that brings you happiness and comfort in the long term. Deciding on the right type of home is a personal decision that requires careful consideration of your needs and desires.

I’m Tanner Murphy, a retired real estate agent from California, now writing for propertyescape.net. I simplify California’s complex real estate laws for readers, making it easier to understand and navigate the market.

Related Posts:

- How Much Tax Do You Pay When You Sell Your House in…

- How to Buy a House in California: All You Should Know

- Home Inspections - How Long Do They Take and How to Prepare?

- Home Price Growth Gained Momentum in February Across…

- Top 8 Home Renovation Projects That Increase…

- Record High Home Prices Lead to 4% Drop in Pending Sales